And then the world was flat.

This was the main theme for the Martha’s Vineyard real estate market in 2023, when two straight years of an unprecedented surge in sales and pricing — largely fueled by the Covid-19 pandemic — began to level off.

And while prices remained at a historic peak last year, sales slowed noticeably as inventory shriveled and interest rates stayed high in a lackluster market.

“We are at the top of a market,” said Debra Blair, president and owner of LINK, the Island mulitple listing service for real estate, speaking to the Gazette by phone last week.

LINK recently completed its annual report for 2023. The report includes detailed sales numbers for all six Vineyard towns and tracks a variety of trends, including the average price index for the Island.

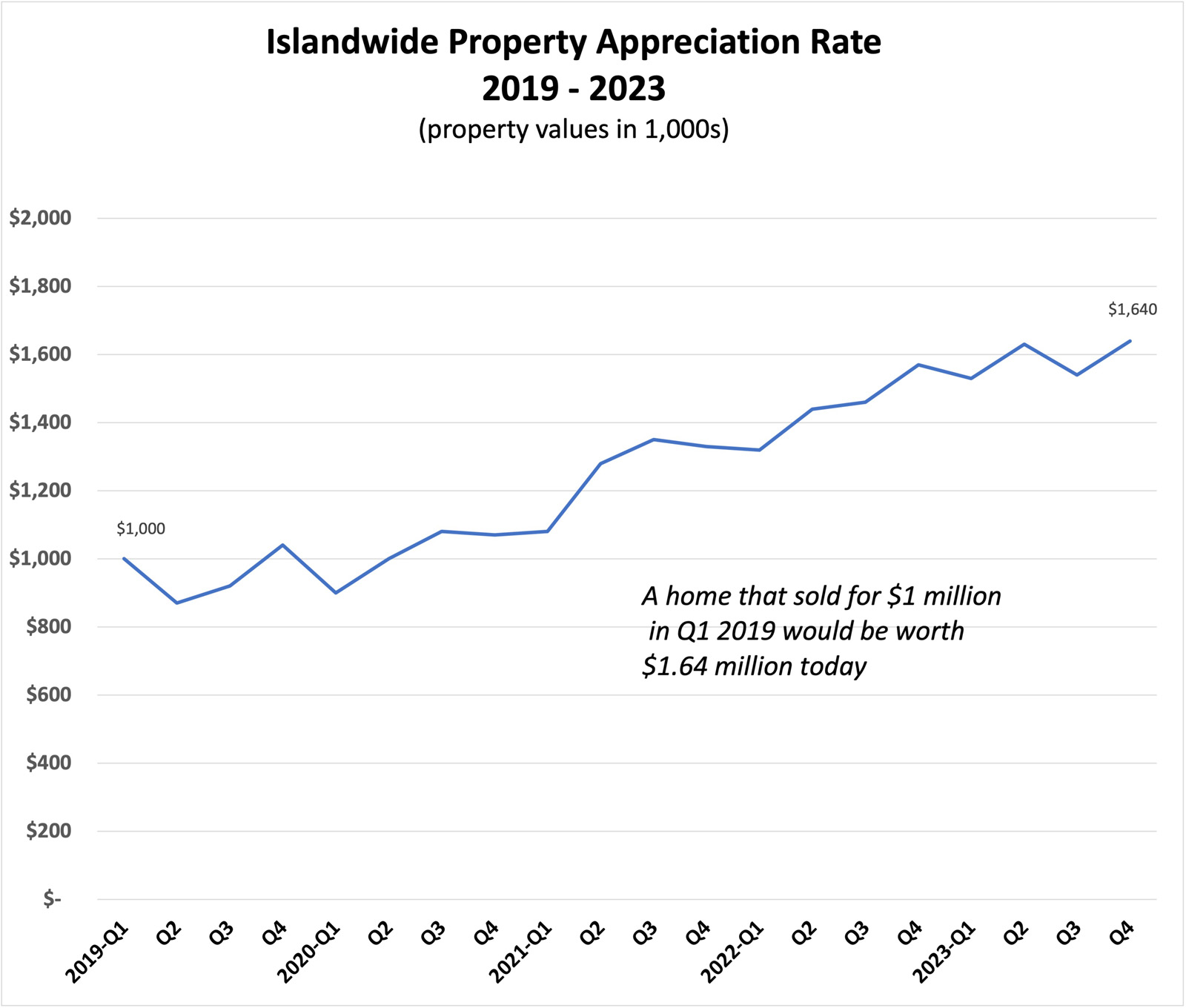

Ms. Blair said the index provides a useful snapshot of what has happened here over time when it comes to appreciating values. Charts in the report show that a house that sold for $1 million in 2019 is today worth $1.64 million. Ten and 15-year snapshots are even more dramatic: a house that sold for $1 million in 2014 is worth $2.4 million today, while a house that sold for $1 million in 2009 is worth $2.61 million, the index report shows.

“The Island is at an all-time high in terms of property pricing and appreciation,” Ms. Blair said.

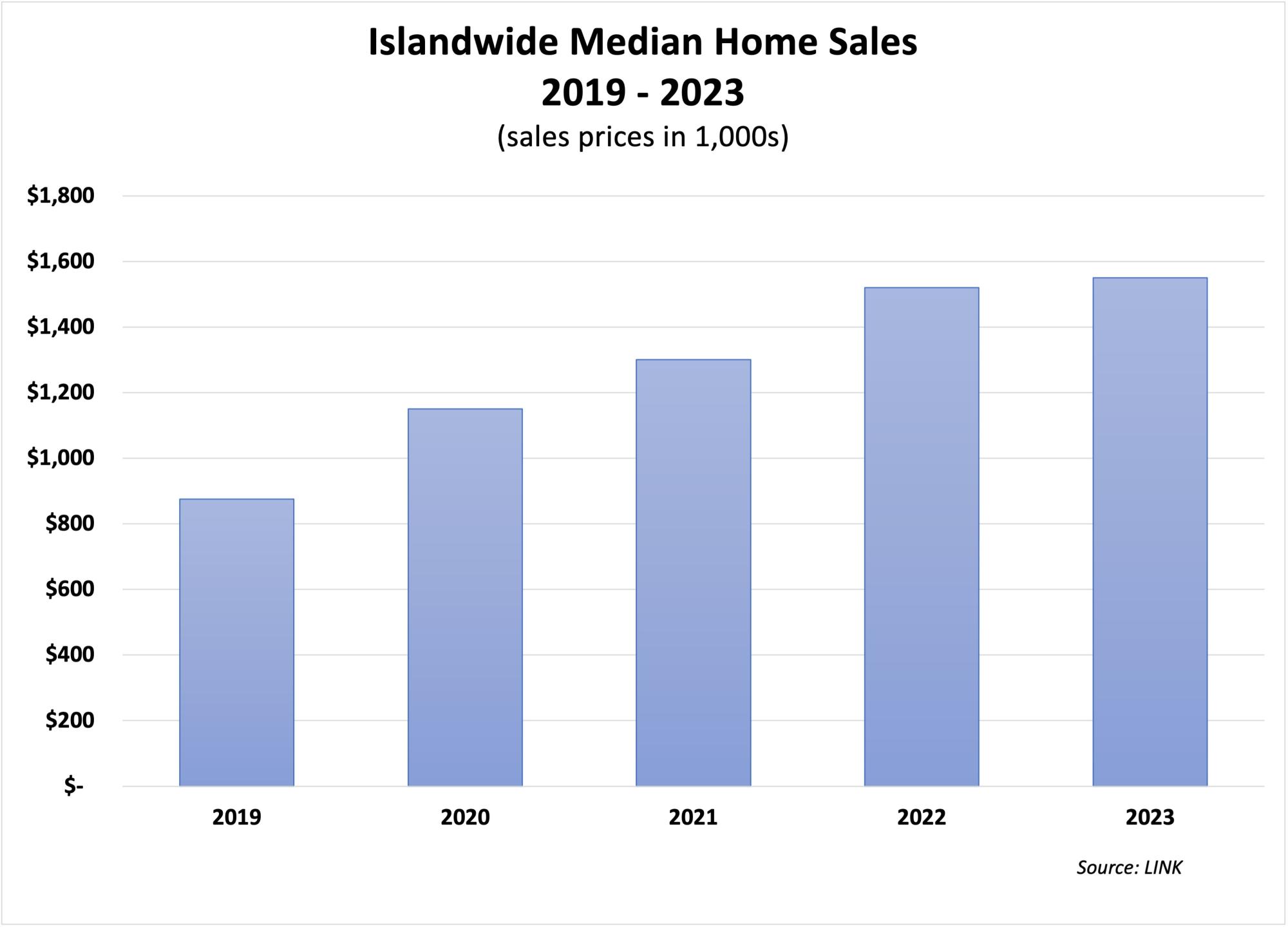

Median sale prices have climbed too and are now flattening, according to the report. Between 2019 and 2020 the median sale price for a single-family home on the Vineyard jumped from $875,000 to $1.15 million, a 31 per cent increase. Over the next two years Islandwide median sale prices kept increasing, to $1.3 million in 2021, an increase of 13 per cent, and then to $1.52 million in 2022, an increase of 17 per cent. Then in 2023 the median sale price stayed essentially flat at $1.55 million.

The LINK report also tracks the recent peaks and valleys in sales inventory, the number of properties on the market at any one time, which Ms. Blair said help paint a fuller picture of what happened last year.

“This historic high for selling prices Islandwide . . . is tied to what I call negative inventory,” she said. She also said she believes high interest rates are a primary cause of what she called “a downward spiral” in available properties.

“Our biggest challenge going into 2024 is a lack of inventory,” Ms. Blair said. “If you’re a buyer, there’s nothing to buy — if you wanted to buy something for under $1.5 million you would be hard pressed to find something livable.” On the other side, Ms. Blair said sellers who may want to move are staying put because they have mortgages that were locked in when interest rates were low.

Data provided by LINK show that out of 407 single family home sales last year, 223 — 55 per cent — included mortgages, while the rest — 45 per cent — were cash sales.

Calendar year numbers for 2023 compiled by the Martha’s Vineyard Land Bank echo the trends of a flattening market. The land bank collects a two per cent transfer fee on most arm’s length real estate transactions and uses the money for a variety of public conservation purposes.

In 2023 the land bank collected $16 million in revenues and recorded 1,433 transactions, roughly the same as in 2022 when it collected $16.9 million and recorded 1,488 transactions.

The two years are a notable dip from 2021, when the land bank collected in $25.9 million in revenues and recorded 1,714 transactions.

Land bank executive director James Lengyel said the numbers speak for themselves.

“Sometimes data are baffling or ambiguous but not these,” he said. “These data decided to be plain: there was a zenith, we descended from the zenith and now they are flat. They’re flat on both revenues and transactions — uncannily so.”

A government organization, the land bank primarily tracks its finances on a fiscal year basis. Halfway through the fiscal year, projections appear to be on target and following the same trend: flat or a little higher than flat, Mr. Lengyel said

“It really is a plain year; I didn’t see anything anomalous . . . it jibes with our forecast as expected,” he said.

Ms. Blair said 2024 still holds unknowns.

“I would say that [the market] is stable but we really need some normalization [of pricing]. We are lacking inventory and high prices are putting both buyers and sellers in an untenable situation. It’s very frustrating for the home buyer and for the home seller who wants to stay on the Island. The hope and the way out of this is more . . . mid to low-priced homes and a reduction in interest rates.”

Comments (4)

Comments

Comment policy »