After a two-year buying frenzy, sales of Island properties ebbed last year and dropped to their lowest level in at least 10 years during the first six months of 2023. Real estate agents across Martha’s Vineyard cited a host of post-pandemic conditions that left inventory low and prices high.

“The market is trying to correct itself,” said Karen Overtoom of Karen M. Overtoom Real Estate in West Tisbury. “During the pandemic, things got way out of whack. We had a lot of people trying to buy what was on the market, which wiped out the inventory and then, due to demand, the prices rose. The market is correcting itself and there are some price reductions on homes that were overpriced.”

“I think we are seeing a combination of fewer things to sell, high interest rates and the economy looming in the back of people’s minds,” said Gerret Conover of LandVest Martha’s Vineyard in Edgartown. “The Covid surge really cleaned out the market — cleaned it out of inventory and cleaned out pent-up buyers. I think we might be experiencing a bit of lag time while we wait for new buyers looking for new properties.”

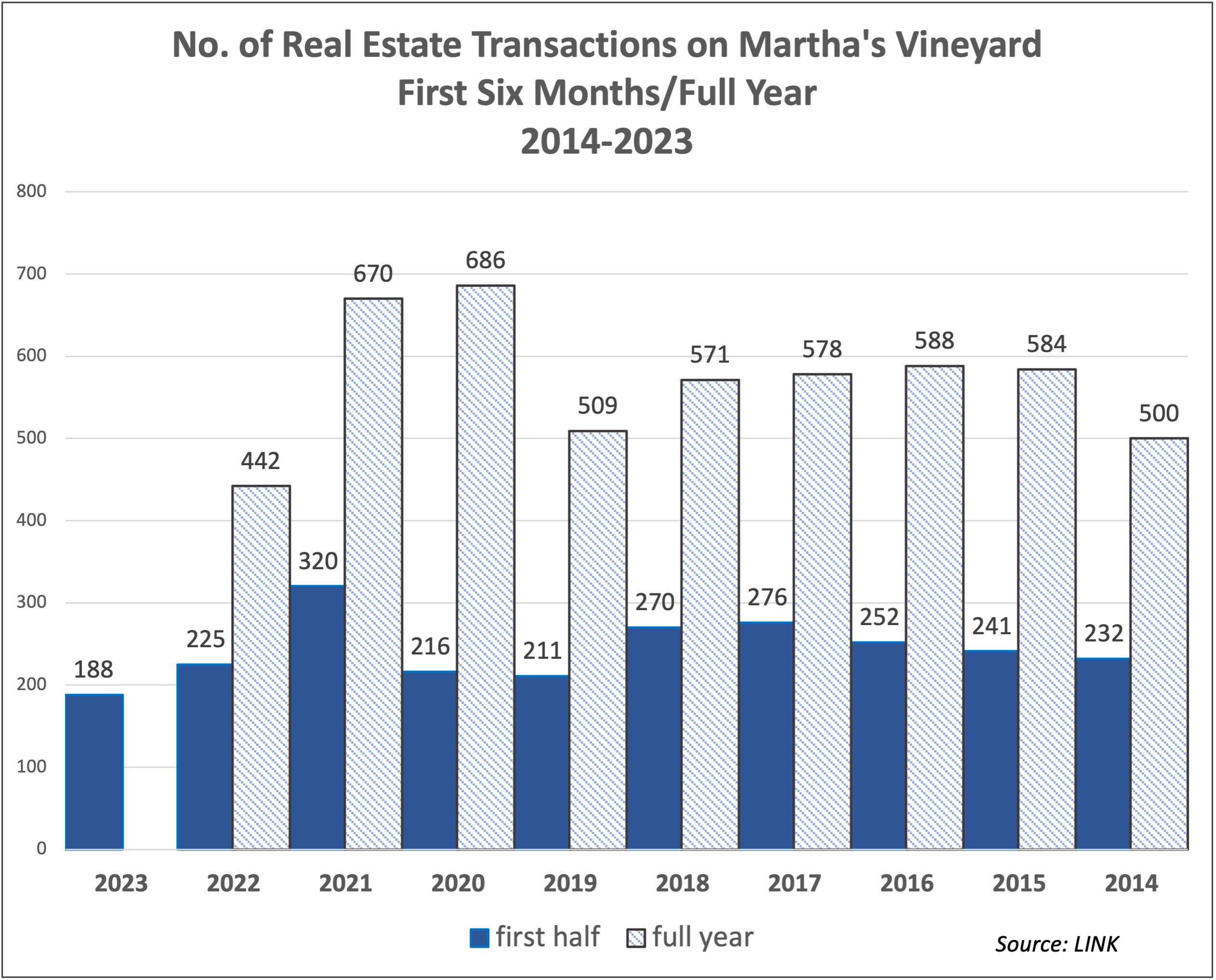

Total sales of Island real estate peaked in 2020, when 686 properties changed hands, including 577 residential properties (the balance are commercial real estate and land). The first half of 2021 saw an unprecedented 320 transactions, including 240 residential sales, and the year ended with 670 total sales.

But the hot streak began to cool in 2022. The flood of buyers during the pandemic drained the housing market, resulting in depleted inventory. Early last year, there were just 103 properties for sale on Martha’s Vineyard, a 10-year low.

Numbers are recorded by LINK, a multiple listing service that provides real estate data to Martha’s Vineyard, Nantucket and Boston. LINK’s president, Debra Taylor, said that the normalization of remote work and the desire to leave urban congestion motivated many of those who bought property during Covid. Residential homes flew off the market, and inventory dipped into the negative.

Beginning in the second half of 2022, inventory began reappearing on the market for the first time since 2020. The number of properties for sale has been rising gradually, reaching 181 last quarter.

But inventory is still significantly lower than it was before Covid, when it consistently saw peaks between 400 and 500 properties and rarely saw numbers below 300.

Ms. Overtoom said the lower inventory might be because homeowners who do not have the financial resources to trade up are thinking more carefully about selling their homes. In previous years, Ms. Overtoom saw a consistent pattern of buyers investing in homes, then selling and buying more expensive homes a few years later. But now the jump between what homeowners can sell for and the price of another Island property is too vast for most local buyers.

“There aren’t a lot of homes on the market right now,” she said. “There are a lot of people that can’t put their house on the market because there isn’t anything available for them to buy. It could mean that they would have to leave the Vineyard unless they have the wealth to afford to buy whatever they want.”

Oak Bluffs real estate broker Marilyn Moses of Ocean Park Realty is seeing similar patterns, and noted that high interest rates on mortgages have had a chilling effect for some.

“Sellers don’t want to lose their interest rate,” she said. “I have sellers who say, ‘I’m in the 2 to 2.3 to 3.2 per cent. Why would I buy another house where I’m hit with a 6 or 7 per cent interest rate?’”

With residents who cannot afford to buy new properties holding onto their existing ones, Ms. Overtoom said the properties available on the market are overwhelmingly high-end or overpriced.

“There are still a lot of buyers out there looking, but the pricing is high and there has to be value in the product or the buyers will wait till something else comes on the market,” Ms. Overtoom said. “Like anything, it’s not black and white. There are some homes that are priced exactly right and there are homes that are overpriced.”

Ms. Overtoom said that the properties that are selling are typically negotiated. She said that she has seen very few offers over asking price.

“If you look at what actually sells, quite a few properties have had a price reduction,” she said. “There aren’t as many bidding wars as there were during the pandemic. There are some people that are putting their property on at sky high prices but those properties tend to be sitting on the market.”

The median selling price for single and multi-family properties during the second quarter of this year was $1,399,000, slightly down from the same quarter of 2022, which saw a median of $1,480,000. Before Covid, the second-quarter median selling price saw its last year under seven figures at $797,500 in 2019 before skyrocketing to $1,199,500 during the second quarter of 2020 — the first year of the pandemic.

LINK also tracks nearby Nantucket, where property prices are almost two times those of Martha’s Vineyard and where the average home costs $3 million. But in using Nantucket as a point of comparison, Ms. Taylor predicted that prices will not falter.

“This is happening everywhere — Vail, Charleston, parts of Florida,” Ms. Taylor said. “The secondary house market has almost become a co-primary market.”

As prices rise, Ms. Taylor said that year-round residents are priced out of the Island, and some capitalize on the opportunity to sell their homes and move off Island. She said that the Island must focus on creating sustainable affordable housing for year-round Islanders.

“We’ve reached the tipping point where we need as many interventions as possible — solutions,” Ms. Taylor said. “This is an Islandwide call to action.”

Heading into the second half of 2023, Mr. Conover said he is already seeing sales on the rise. August and September are the busiest months for real estate sales on the Island, which Mr. Conover attributes, in part, to residents hoping to squeeze one last summer out of their homes before selling.

“You’d think people would start looking at the beginning of the summer to beat the real competition, but really what you see is people starting to look in earnest at the end of July,” he said. “The next 60 days are the best 60 days of the year.”

Comments (13)

Comments

Comment policy »